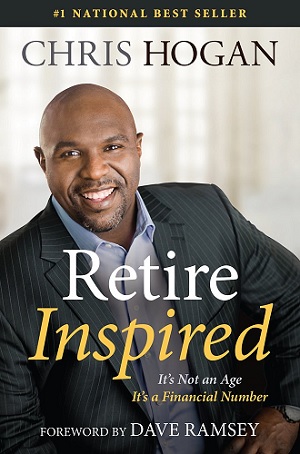

Retire Inspired: It’s Not an Age, It’s a Financial Number by Chris Hogan is a comprehensive guide on how to plan for a financially secure retirement. In the book, Hogan emphasizes that retirement isn’t about reaching a certain age but about achieving a specific financial goal that allows you to live comfortably. He walks readers through the steps required to build wealth, plan for retirement, and maintain financial security well into their later years. Below is an extensive breakdown of the key lessons from the book.

Read: I Will Teach You to Be Rich

1. Retirement Is a Financial Number, Not an Age

The central lesson in Retire Inspired is that retirement is not tied to an age but rather to a financial number. Hogan stresses that the amount of money you need to retire comfortably depends on your desired lifestyle, not when you turn 65. Everyone’s “Retirement Dream” is different, and reaching that point depends on how much you save and invest, rather than waiting for a specific age.

Lesson: Retirement isn’t an age; it’s a financial goal. Your focus should be on saving and investing enough money to live the lifestyle you want in retirement, rather than aiming for a specific retirement age.

2. Start Planning Early: Time Is Your Greatest Asset

Hogan emphasizes the importance of starting your retirement planning as early as possible. The earlier you start, the more time your investments have to grow due to the power of compound interest. Even small, consistent investments made early on can grow into substantial sums over time, making it easier to reach your retirement goals.

Lesson: Time is the most valuable asset in retirement planning. Starting early allows your money to grow exponentially, making it easier to build a substantial retirement fund.

3. The Power of Compound Interest: Small Investments Grow Over Time

Hogan dedicates a portion of the book to explaining the power of compound interest. He shows how even modest monthly contributions to a retirement fund can grow significantly over decades. The key is consistency. By regularly contributing to retirement accounts like 401(k)s, IRAs, or other investment vehicles, you can take advantage of compound growth and steadily increase your retirement savings.

Lesson: Compound interest is a powerful tool for wealth-building. Consistent contributions over a long period allow your money to grow faster, making it easier to achieve your retirement goals.

4. Avoiding Debt: Debt Hinders Retirement Progress

In line with many personal finance experts, Hogan stresses the importance of avoiding debt. High-interest debt, such as credit card balances or personal loans, can severely impact your ability to save for retirement. Hogan argues that debt acts as a financial weight, dragging down your efforts to build wealth and slowing your progress toward retirement.

Lesson: Eliminating debt is crucial to maximizing your retirement savings. Debt diverts money away from your investments, reducing your ability to grow your wealth for the future.

5. Living on a Budget: Creating a Plan for Financial Success

Hogan emphasizes the importance of living on a budget to manage your finances and prioritize saving for retirement. By creating and sticking to a detailed budget, you ensure that your income is allocated toward essentials, savings, and investments, rather than unnecessary spending. Hogan encourages readers to take control of their money by tracking expenses and being intentional with how they spend.

Lesson: Budgeting is a critical component of financial success. A well-planned budget helps you prioritize saving for retirement and ensures that your spending aligns with your long-term financial goals.

6. Know Your Retirement Dream: Define What Retirement Looks Like for You

Hogan introduces the concept of the “Retirement Dream,” urging readers to define their ideal retirement lifestyle. Whether it’s traveling, pursuing hobbies, or spending time with family, your retirement vision will influence how much money you need to save. By getting clear on your personal retirement goals, you can better estimate your financial target and adjust your savings and investments accordingly.

Lesson: Defining your “Retirement Dream” helps create a concrete financial target. Knowing what you want your retirement to look like allows you to plan more effectively and determine how much you need to save.

7. Investing for Retirement: Making Your Money Work for You

Hogan emphasizes the importance of investing in retirement accounts such as 401(k)s, IRAs, or Roth IRAs to build wealth over time. He advocates for maximizing employer-sponsored retirement plans, taking advantage of matching contributions, and consistently investing in diverse portfolios that include stocks, bonds, and mutual funds. Hogan also stresses the importance of understanding risk tolerance and adjusting your investment strategy as you get closer to retirement.

Lesson: Investing is a vital part of retirement planning. By consistently contributing to retirement accounts and leveraging investment growth, you can build a retirement fund that will support your financial goals.

8. Emergency Fund: Preparing for Life’s Unexpected Events

Hogan emphasizes the importance of having an emergency fund to cover unexpected expenses, such as medical bills, home repairs, or job loss. He suggests building an emergency fund that covers three to six months of living expenses. This fund acts as a financial buffer, ensuring that unexpected costs don’t force you to dip into your retirement savings or take on debt.

Lesson: An emergency fund is essential for financial security. It protects you from unexpected expenses and ensures that your retirement savings stay intact during tough times.

9. Stay Motivated and Accountable: The Power of Financial Coaching

Hogan underscores the value of staying motivated throughout your retirement planning journey. He advises seeking out a financial coach, mentor, or accountability partner to keep you on track and motivated to reach your financial goals. He also recommends celebrating small wins along the way, such as paying off debt or hitting savings milestones, to maintain motivation and stay committed to your retirement goals.

Lesson: Staying motivated and accountable is key to achieving financial success. Financial coaching and support can help you remain focused and disciplined on your path to retirement.

10. Social Security Is Not Enough: Don’t Rely Solely on Government Benefits

Hogan cautions readers against relying on Social Security as their primary source of retirement income. He points out that Social Security was designed to be a supplement, not a full retirement solution, and may not be enough to cover your expenses. Instead, Hogan emphasizes the importance of taking control of your own retirement through savings and investments.

Lesson: Social Security benefits should not be your primary retirement plan. Building personal wealth through saving and investing is essential for a comfortable retirement.

11. Be Patient and Consistent: Long-Term Success Takes Time

Hogan reinforces the importance of patience and consistency in retirement planning. Building wealth and preparing for retirement is a long-term process that requires discipline and a steady commitment. He encourages readers to avoid get-rich-quick schemes and instead focus on a methodical approach to saving and investing, trusting that time and consistency will yield results.

Lesson: Patience and consistency are critical in retirement planning. Long-term financial success takes time, but steady saving and investing will lead to financial freedom in retirement.

12. Leaving a Legacy: Planning for Future Generations

In addition to planning for your own retirement, Hogan encourages readers to think about the legacy they want to leave for their families. By building wealth and managing your finances well, you can provide for your children and grandchildren, ensuring their financial well-being. Hogan suggests working with financial planners or estate planners to ensure that your wealth is transferred responsibly to future generations.

Lesson: Retirement planning isn’t just about you; it’s about leaving a legacy. Thoughtful financial planning allows you to provide for your family and ensure a lasting impact for future generations.

13. The Retirement Dream Team: Surround Yourself with Experts

Hogan advocates for building a “Retirement Dream Team” of financial professionals to guide you through the complexities of retirement planning. This team may include financial advisors, tax professionals, and estate planners who can help you make informed decisions about investments, taxes, and asset protection. Hogan emphasizes that working with knowledgeable experts can help you maximize your retirement savings and avoid costly mistakes.

Lesson: Surround yourself with financial professionals who can guide you through retirement planning. A well-rounded team of experts ensures that your finances are managed effectively, allowing you to retire with confidence.

Conclusion

Retire Inspired offers a clear and actionable plan to achieve a financially secure retirement. Chris Hogan emphasizes that retirement is not defined by age, but by financial preparedness. The key lessons in the book stress the importance of starting early, investing wisely, eliminating debt, and being consistent in your efforts to build wealth. By following Hogan’s advice, readers can take control of their financial future and create a retirement that allows them to live comfortably and confidently (Amazon).